(This post was originally published at i3.investor.com)

As you know, there are several share selection criteria such as P/E ratio, dividend yield, NTA, cash flow, price to book value etc. Almost all professional fund managers and ordinary investors consider P/E ratio most important. As a result, they miss out to buy companies with poor current earnings but have tremendous profit growth potential.

Statistics show that this kind of investors cannot outperform the market index. Records show that in the last 10 years, 76% of professional fund managers and most day traders cannot outperform the market index, because they concentrate too much on current earnings and do not look at the future profit growth of the companies. They are very shortsighted.

As you know, palm oil price, like most commodities, moves in a cycle. It has been depressed for about 2 years and it is beginning to turn around. CPO price has increased by Rm 50 per tons yesterday. As a result all plantation companies show poor current earnings and most fund managers and the average investors are not interested to buy them. That is why their share prices are so cheap.

In my opinion, I consider the most important share selection criterion is profit growth prospect.

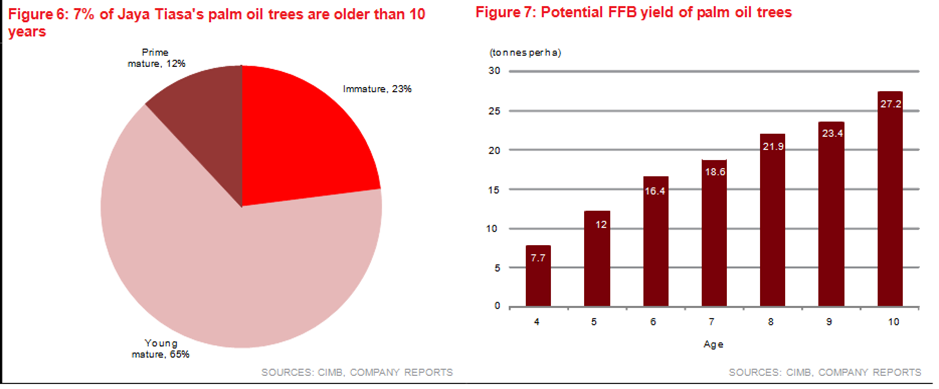

After having said that, you must also understand the plantation industries. It takes about 1 or 2 years to clear the forest before planting. The palms will only start to bear fruits after 4 years of planting. Moreover, in the early stage of fruiting, the quantity is so little and it is still not profitable. It is will only begin to show profit when the palms are 5 or 6 years old, ie more than 7 years from the time of forest clearing. But palms will continue to bear fruits even when the palms are more than 25 years old.

If you look at the world map, you will notice that two small countries, Indonesia and Malaysia produce more than 90% of palm oil. Fortunately, our biggest buyers China and India cannot grow oil palms. Moreover, oil palms can produce eight times more oil than soya beans per hectare.

According to recent study, due to the increase of population and economic advancement, an additional 6 million ton of eatable oil is required annually. Where can they find so much additional land to plant soya beans?

The American smear campaign that soya oil is better than palm oil is proven to be untrue. That is why according to the US Food safety regulations, all potato chips cannot be fried with soya oil.

Jaya Tiasa Profit Growth Prospect

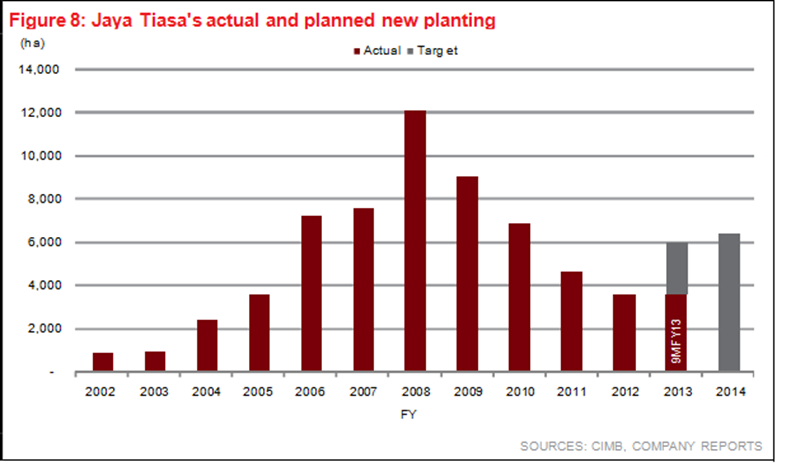

Basing on the Jaya Tiasa’s planting programme and the FFB production at various age of the palms as shown on the charts below, I have calculated the FFB production for the current year 2013 which is 675,000 ton and in 3 years time 2016, its production will be 1,225,000 ton.

Palms older than 10 years old, I assume conservatively that it can produce 30 ton per ha.

Year Ha Planted 2013 age FFB produced 2016 age FFB produced

2002 1000 11 30,000 ton 14 30,000 ton

2003 1,000 10 27,200 ton 13 30,000 ton

2004 2,500 9 58,500 ton 12 75,000 ton

2005 3,500 8 75,300 ton 11 105,000 ton

2006 7,000 7 130,002 ton 1 0 190,000 ton

2007 7,500 6 123,000 ton 9 175,000 ton

2008 12,000 5 144,000 ton 8 258,000 ton

2009 9,000 4 69,300 ton 7 167,000 ton

2010 7,000 3 — 6 115,000 ton

2011 4300 2 —– 5 52,000 ton

2012 3,700 1 —- 4 28,000 ton

2013 3,700 0 —- 3 —-

Total 62,200 Ha 657,000 ton 1,225,000 ton

Good profit growth prospect

In 3 years time the production will be increased by nearly 90 % and the profit will be increased a lot more because the cost for producing the additional FFB is only for additional fertilizer and labour for harvesting which are relatively small.

Undervalued

On 27th Sept 2013 Boustead made this announcement:

BOUSTEAD HOLDINGS BERHAD (“BHB” OR “COMPANY”) PROPOSED ACQUISITION OF TWO (2) PIECES OF OIL PALM PLANTATION LAND IN DISTRICT OF LAHAD DATU, SABAH MEASURING APPROXIMATELY IN TOTAL 2,409.8 HECTARES BY BOUSTEAD RIMBA NILAI SDN. BHD, A WHOLLY OWNED SUBSIDIARY OF BOUSTEAD PLANTATIONS BERHAD, WHICH IN TURN IS A WHOLLY-OWNED SUBSIDIARY OF BHB FROM UNIGLOBAL SDN. BHD. (“UNIGLOBAL”) FOR A TOTAL CASH CONSIDERATION OF RM184,596,825 (“PROPOSED ACQUISITION”)

More recently IOI has announced that it is buying Harn Len Corporation’s plantation at about Rm 79,000 per ha.

Boustead is buying the plantation at Rm 76,598 per ha. Basing on this rate JT’s 62,200 ha is worth Rm 4.76 billion while its market cap is 974 million issued shares X Rm 2.14 = Rm 2.08 billion.

Timber Business:

How do you value its timber business, one of the largest if not the largest in Malaysia and its large forest concession which is about 2400 square kilometers?

The price has been depressed for more than a year, since the bonus issue of 2 for every one share held. A few long term investors bought 15% of the total issued shares at Rm 7.90 per share before the bonus issue which is equivalent to Rm 2.63 per share. The closing price on 31st Oct was Rm 2,13.

I am obliged to tell you that Jaya Tiasa is my major investment and I am not asking you to buy it.