Koon Yew Yin 3 Nov 2020

Statistics shows that 80% of the investors lose money, 10% break even and only 10% of the investors make money from the stock market. In fact, due the Covid 19 pandemic, the number of winners would be less than 10%.

Fear is investors’ the biggest obstacle. The winners are not afraid to take risk. But the losers are so fearful of so many things.

Currently the losers are fearful of the following:

1 The number of Covid 19 cases are increasing and the Government will impose lockdown which will affect everyone and every business. More people cannot find work and most businessmen will lose money.

2 Our local political uncertainty. Anwar went to see the Agong with enough of MPs to support him to be the next PM but nothing happens??

3 US election, who will be the next President? What will happen to the stock market if Trump loses?

4 US-China trade war may lead to military confrontation. If that happen, all the stock markets around the world will collapse.

5 Our Government may impose windfall tax on glove companies because they are making unpresented profit due the excessive demand for gloves during the current Covid 19 pandemic.

6 Even our local famous fund manager and Investment Banks advised all their clients or subscribers to avoid the stock market.

If you have sold your glove stocks because you are fearful, you must be a big loser.

Why the Hong Kong Investors were so fearful?

The photo above shows that the small Chinese sampans fighting against the British warships in 1840 when the Chinese refused to buy opium from the British. Since China lost the 2 opium wars, Hong Kong and Kowloon were ceded to the British as reimbursement for loss of opium sales. It is so ridiculous. In fact, when I was a boy, many of my relatives smoke opium and the British had opium sale outlets in every town in Malaya.

This reminds me of my experience in 1983 when China gave notice to the British Government to recover the sovereignty of Hong Kong. Almost all the Hong Kong investors were so fearful and they sold their holdings aggressively. The stock market crashed.

The Hang Seng Index plunged to below 1,000 points. There were so many cheap and undervalued stocks for me to pick. My first pick was Hong Kong Realty & Trust (HKR&T). The controlling shareholder of HKR&T was a Jew called Mr Willock Marden. Just before the market crash, HKR&T sold a multi storey building called Willock House. As a result, HKR&T was cash rich. Each share had more than $10 cash and the shares were selling at Rm 3.00 each.

To cut the story short, I made so much money and within 3 years, I bought 46% of a stock brokering company called Kaiser Stock and Share Co. Ltd.

Warren Buffett’s saying “to be greedy when others are fearful”

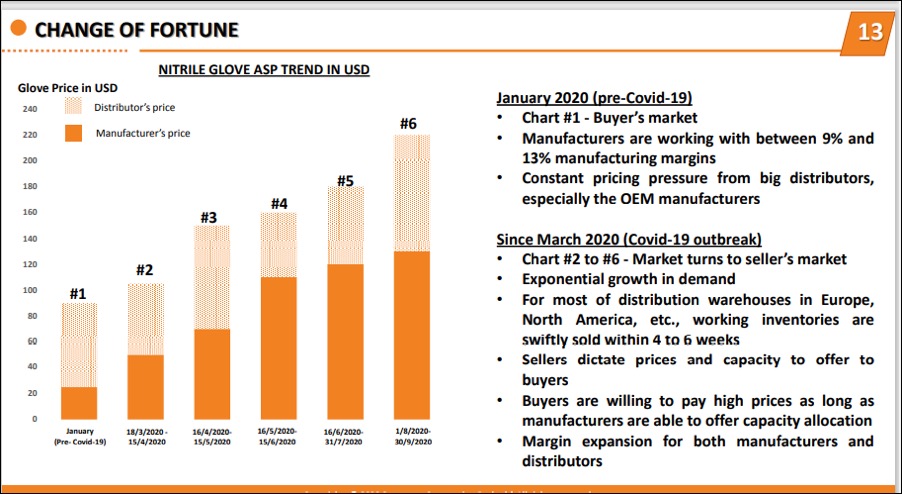

Covid 19 pandemic is affecting everyone and all the listed companies except medical glove and medical products for virus prevention. The demand for gloves far exceeds supply. As a result, glove makers can easily increase their selling prices to make more and more profit.

Among all the glove makers, Supermax is the best glove stock to buy because it has the best profit growth rate. Moreover, it is the cheapest in terms of P/E ratio and NTA as shown on the page 13 and 25 of the company’s briefing to shareholders.

Please note that the daily traded volume is tens of million shares and whether you buy or sell does not make any difference.