Koon Yew Yin 11 Sept. 2020

All the glove stocks have been plunging down in the last 2 weeks. As a result, many investors are forced to sell to meet margin calls. This reminds me of my expensive mistake in early January when Dayang dropped like a bomb and I was forced to sell to meet margin call. I will never forget this expensive lesson. Fortunately, in this case, I sold earlier when most investors were rushing to buy Supermax and Top Glove for their bonus share issues. When I posted articles to encourage investors to sell many of my readers including fund managers were avoided.

Forced selling will depress the price further down which will create more forced selling. It is a vicious cycle.

Besides forced selling, many weak-minded holders were following like sheep to sell their holdings. Moreover, many investors were fearful that the demand for glove will be reduced in view of the discovery of vaccine. Even if FDA eventually approves the vaccine, it will take a long time to produce enough to vaccinate everybody in the world. Unless everybody is vaccinated, the virus will continue to spread.

Top Glove share buy back

Top Glove Corp. Bhd spent nearly Rm 100 million on share buy backs. The glove maker said it bought back 14.93 million shares at between Rm 6.12 and Rm 7.40 for a total sum of Rm 99.93 million. Yesterday the company repurchase 1.34 million for nearly Rm 10 million.

Supermax also bought back its own shares yesterday.

Supermax has dropped from Rm 11.20 to close at Rm 6.10, a drop of 46%. Top Glove has dropped from Rm 9.30 to Rm close at Rm 6.45, a drop of 30% in the last 2 weeks as shown on the charts below.

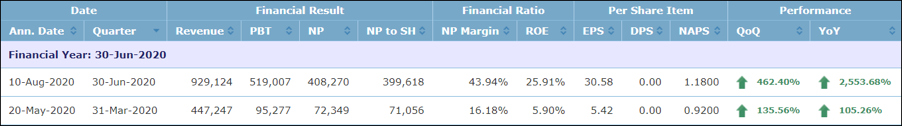

Among all the glove stocks Supermax has the best profit growth prospect as shown in its latest quarter ending June. Its EPS was 30.58 sen, quarter on quarter 462% and year on year 2,553% as shown on the table below. This indicates that the company has its own brand and sale outlets in all major cities in US so that the company can easily increase its selling price for gloves.

As Benjamin Graham said in the short term the stock market is a voting machine and in the long term it is a weighing machine. To be a successful investor, you must be able to control their emotion of fear and greed. You must buy when people are rushing to sell and you must sell when people are rushing to buy as if tomorrow is too late.

Statistics shows that almost all short-term day traders lose money and long-term investors make more money in the stock market.

I think all the glove stocks are oversold. I hope they will rebound soon.

In the last 2 days, just like me, a few Investment Banks have posted buy recommendations for glove stocks. Perhaps they already have bought enough of glove stocks while the prices were dropping. The following is a fine example:

Top Glove Corporation Aiming for top results

■ We reiterate our positive view on TOPG post a recent conference call with management which yielded no major surprises.

■ TOPG expects higher ASP, particularly for nitrile gloves at +20% mom in Sep and Oct 20, and another +10% in Nov 20 due to strong demand for gloves.

■ Maintain Add with an unchanged TP of RM9.20 (18x CY21 P/E).

Order visibility for NBR gloves extended to 20 months Owing to Covid-19, Top Glove (TOPG) continues to witness robust glove demand as its sales lead time for nitrile glove is now >20 months until end-CY21 (natural rubber gloves: 13 months; vinyl gloves: 8 months; surgical gloves: 4 months), from 18 months in Jun 20. Despite increased news flow on potential discovery of a Covid-19 vaccine, TOPG believes that glove usage globally will remain strong even in the event of a discovery of a Covid19 vaccine, mainly due to increasing healthcare and hygiene awareness in developing countries, as well as increased usage in both medical and non-medical sectors. Continues to see increasing ASP trend TOPG expects further ASP increases for nitrile gloves at +20% mom in Sep and Oct 20, and potentially another +10% mom in Nov 20. Besides, TOPG also sees ASPs for latex gloves increasing 5% mom in Sep and Oct 20. This is also supported by TOPG recently receiving more spot orders until end-CY20F as it expects to allocate up to 30% (from 20- 25% previously) of its total capacity for spot orders going forward. Note that our current FY20F/21F/22F ASP growth estimates stand at +22%/+45%/-36%.