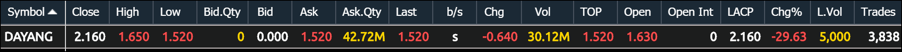

Yesterday Dayang share price dropped 30% or 64 sen to limit down and at the close there were 42.72 million shares queuing to sell at Rm 1.52 as shown below.

The reason why so many millions of share queuing to sell is because of forced selling to meet margin call.

Forced selling is a vicious cycle

The more forced selling the more the price will drop which will create more forced selling. It is a vicious cycle. Unfortunately, all the investment banks have to force sell their customers’ shares to protect their own interest.

If it dropped another 30 % or 46 sen to limit down, it will be Rm 1.06 and thousands of minority shareholders will be badly hurt.

The price was Rm 2.94 on 21 February, Rm 2.16 on 6 March and Rm 1.52 on 9 February.

Currently as I am writing at 11.30 am, the price has dropped 26 sen or 17% with more than 93 million shares changed hands. Only investment banks have so much money to buy 93 million shares. When the price was going higher and higher, the investment banks would encourage their customers to use margin finance to buy more shares. They even lower their interest rate to 4.6% PA.

When the price dropped so drastically, the investment banks are forced selling their customers’ shares without their consent and they are buying back at cheap sale prices to make more money.

Dayang basic fundamental

Dayang has very good profit growth prospect. Dayang’s EPS 24.3 sen in 2019 and EPS 17 sen in 2018. Its share price went up rapidly to strike a high of Rm 2.94 on 21 February.

Yesterday oil price dropped about 30% but it should not affect Dayang because it is not involved in oil extraction. It is an oil rig maintenance contractor. Even if the oil price drops drastically Petronas will continue to pump because the company has already paid the cost of all the oil rigs. In fact, when the oil price drops so drastically, our Government will require Petronas to pump more oil and Dayang will have more maintenance contracts. Currently Dayang has more than Rm 2 billion worth of contracts which will keep the company busy for the next 2 years.