Koon Yew Yin 17 Feb 2021

Many investors must have sold their glove stocks to buy tech stock. Is this a wise move?

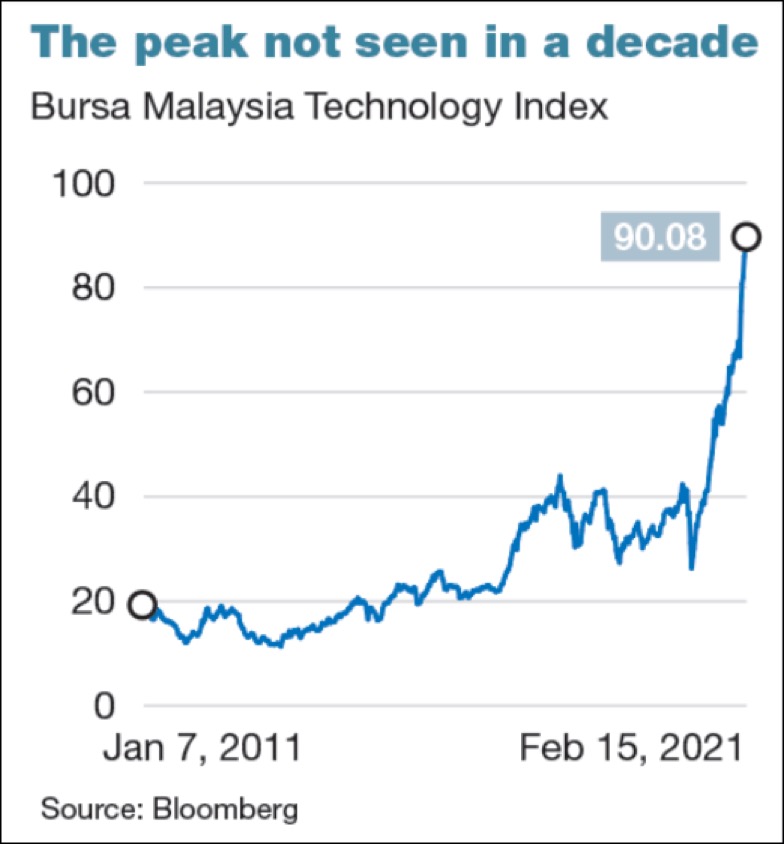

Bursa Malaysia’s Technology index is more than two-decade high of 90.08 points on Monday, the highest level since the burst of the dot-com bubble in 2000.

All the glove stocks have been dropping in last 5 months. For example; Supermax dropped from Rm 11.07 to close at Rm 6.09, a drop of Rm 4.97 or 45%. It defies investment logic. It rebounded 23 sen today to close at Rm 6.09.

Many investors must have sold their glove stocks to buy tech stock. Is this a wise move?

While the glove stocks are trying hard to regain lost ground after falling off the peaks, the technology stocks are gaining. Tech stocks are primarily involved in semiconductor-related business.

Reaching fresh peaks has become a daily affair among some tech stocks in recent months amid news that the semiconductor industry is facing a happy problem — supply growth could not keep pace with the strong surge in demand. The auto industry is one of them currently suffering from severe semiconductor chip shortage.

Tech stocks that have gained less than 30% year to date would have been considered laggards among their peers. The best performers which have chalked up at least 40% gain since the start of the year are UWC Bhd, Malaysian Pacific Industries Bhd (MPI), Unisem (M) Bhd, and Greatech Technology Bhd.

Over a longer horizon, all of their share prices have at least doubled since March 18 last year when the global equity rout, which was triggered by the panic selling amid pandemic fears, rocked the global markets. UWC tops the winner list with gain of over 1,000% since March 18, followed by Greatech, whose share price has leapt 631%.

The surge in share prices lifted Bursa Malaysia’s Technology index to a more than two-decade high of 90.08 points on Monday, the highest level since the burst of the dot-com bubble in 2000.

Tech Stocks Exorbitant valuation

With share prices having risen in such a meteoric fashion, some of the tech stocks have reached historical price-earnings ratio (PER) of over 100 times — something that has not happened since the dot-com boom.

For examples, UWC has a PER of 135.05 times, and Unisem holds a PER of 125.54 times. The lowest PER among the semiconductor companies is MPI, with a PER of 43.88 times.

Glove Stocks under valuation

Glove stocks has been dropping in the last 5 months. Investors must have sold their glove stocks to buy tech stocks aggressively.

This is not a wise move based on fundamental valuation.

For example, Supermax’s 1st quarter ending Sept EPS 30.58 sen. Its 2ndquarter ending Dec EPS 41.14 sen, totalling 71.72 sen for 1st half year. The 2nd half year should be more than the 1st half year because of the surge in demand for gloves due to the Covid 19 pandemic.

Glove stocks have bright future

Many scientists predicted the Covid 19 pandemic will take at least another 4 or 5 years to be under control despite massive vaccination because at least 70% of the world population must be vaccinated. Otherwise, the virus will continue to spread. Moreover, many poorer countries cannot afford to buy vaccines to vaccinate their citizens. Based on this fact, the demand for glove will continue to exceed supply and all the glove makers can easily increase their sell prices to make more and more profit.

Assuming its 2nd half year profit is the same as the 1st half year, its annual profit will be 71.72 X 2 = Rm 1.43 EPS. Based on PE 10, its price should at least Rm 14.30 per share.

Supermax has the best profit growth rate among all glove stocks. Based on the current price of Rm 6.09, it is sell at PE 4 while most of the tech stocks are selling at PE about 100.