(This post was originally published at klse.i3investor.com)

My main objective to reproduce this article is to teach you how to become a super investor. My intention is noble but it would seem that I am boasting again.

As I said many a time before, there are many share selection criteria such as P/E , dividend yield, price to book value, NTA etc, but I consider the most important criterion is profit growth prospect.

Before you buy any share you must make sure that the company can make more money this year than last year and it can make more money next year than this year and continue to make increasing money in the foreseeable next few years.

Jaya Tiasa has this ability of producing more and more profit in the next 10 years. Now you, especially kk123 & wt222 who has ridiculed me before must go back to study my article “Why I sold R Sawit and SOP to buy Jaya Tiasa”. It is important for those who have not been successful in stock picking must change their old style or mind-set. Kk123 & wt222 must examine your track record to realise how well you have performed before you dare to ridicule me.

I published the following article on Tradewinds Plantation on

Koon Yew Yin- 22nd Feb 2013

There are many famous cash rich plantation companies but they are usually fully valued. Of course, it is very safe to buy them but I prefer to buy undervalued shares and take some calculated risk to earn exceptional profit.

On 19th March 2012, UOB Kay Hian published a report on Tradewinds Plantation (TWSP). The salient points are:

a) TWSP is the sixth-largest plantation company in Malaysia by planted area. Only six listed plantation companies in Malaysia have a planted area of over 90,000ha each.

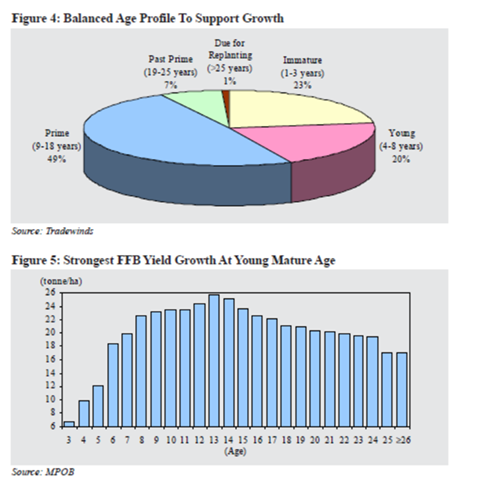

b) Its FFB production to grow at 3-year CAGR of 13.4%. Fresh fruit bunch (FFB) production is expected to grow 12-15% in 2012-14, higher than industry growth of 5-8%. The strong production growth will be supported by: a) 11% pa increase in mature area for the next four years, b) 20% of young areas to provide strong double-digit growth, and c) yield improvement in its prime areas (49% of planted areas).

c) It is a hidden gem. All TWSP’s land is within Malaysia. Given the scarcity of land in Malaysia, its land would be more valuable than similar land in Indonesia. At the current plantation land market price, Tradewinds’ RNAV would be RM19.58, significantly higher than its current share price.

With its FFB production increases by 13% (compound annual growth rate) and its recent acquisition, TWSP has more planted land and FFB production than Genting Plantation.

FFB production (Tons): Dec 2012 – Nov – Oct – Sept total

TWSP 149,000 – 167,000 -178,000 – 154,000 = 648,000

Genting Plant 155,000 – 156,000 – 149,000 -147,000 = 607,000

Basing on the closing share price on 21th Feb 2013 the market capitalisation of TWSP is Rm 4.42 X 529 million issued shares = Rm 2,338 million and Genting Plant is Rm 8.42X 759 million issued shares = Rm 6,390 million.

That is why the controlling shareholders want to buy up all TWSP shares that they do not own. Under the takeover code, they cannot do it because I have accumulated sufficient shares to block them.

If you decide to buy TWSP, I am not responsible for your profit or loss.