Corruption: Forms and Impact

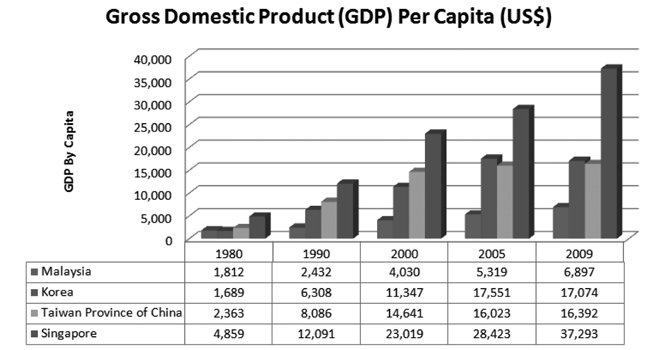

This table shows the GDP per capita performance of Korea, Taiwan, Singapore and Malaysia. All Malaysians should be interested to know why we are performing so badly in comparison with our neighbours in spite of the fact that we have some natural resources, like fossil fuel, tin, rubber and palm oil which they do not have.

Source: Gross Domestic Product (GDP) per capita (various years), International Monetary Fund (IMF)

There are a number of reasons why our economic and human development performance has been so lacklustre. One critical factor that cuts across all explanations of causative factors is that of corruption and leakage.

Over the years, countless cases have been highlighted by members of the opposition and civil society activists, unfortunately with little or no coverage or analysis by mainstream media or accountability by the responsible authorities. Lately though it is encouraging to note that it is not the usual chorus of critics that are raising concerns. The National Economic Advisory Council (NEAC), established by the government with the specific mandate to formulate a New Economic Model (NEM) to drive Malaysia’s transformation into an advanced nation by 2020, has identified ineffective institutions and widespread corruption as the most significant barriers to growth.

Corruption comes in various forms, but where it counts most is where the government uses taxpayers’ money for the wrong reasons. Hundreds of billions of ringgit of public monies which could have been invested in the future of Malaysia – such as in education and healthcare – have instead been leaked out to line pockets of well-connected individuals. The costs of corruption are highlighted in the excerpt from the Government Transformation Programme below.

Bail-outs are a good example. Through the years, national funds have been used to save government corporations or failing companies that are politically connected. In the 1980s, then Prime Minister Dr. Mahathir Mohamed pushed for privatisation of national institutes or public corporations, arguing that that it would improve efficiency in the bureaucracy as well as reduce expenditures. Instead the reverse took place, with the government having to bail out corporations such as Bank Bumiputera Finance (RM2 billion), Star Light Rail Transit (RM3.3 billion), Putra Light Rail Transit (RM4.5 billion) and Malaysian International Shipping Corporation Berhad (RM1.5 billion) in the 1990s.

More recently, the government has come under flak for overpaying to the tune of several hundred million ringgit for two problem-prone submarines purchased from France. Speculation is rife that in these and many similar cases, Malaysian officials and politicians, involved in the deal, were keeping a significant cut for themselves. Critics have fingered the country’s defence bill not only as a major source of illicit outflows and kickbacks but also of the wrong development priorities. In the latest 10th Malaysian Plan, RM23 billion was allocated for defence and security.