During my last 31 years in share investing, I realize that not one single strategy can work all the time because all business operations face different challenges at different time. As a result, their share prices fluctuate and I have to change my strategy quiet frequently to make profit.

How can I find a strategy that I do not have to change so frequently? How can I find a company that can consistently make increasing profit?

As you know, in Malaysia, we do not have companies like Coco Cola, Gillette Razor and MacDonalds which have the competitive market advantage to generate increasing profit consistently. But we have well managed plantation companies like KLK and Batu Kawan which produce palm oil.

Fortunately for us, only Indonesia and Malaysia have the most suitable climactic condition for growing oil palms in the world and our largest buyers India and China cannot grow oil palms. That is why almost all the palm oil is produced in Indonesia and Malaysia.

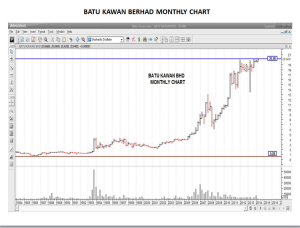

The long term Batu Kawan chart shows that its price was Rm 2,50 in 2001 and currently it is Rm Rm 20.00 , an increase of Rm 17.50 in 13 years, ie 7 times in 13 years.

The long term KLK chart shows that its price was Rm 4.00 in 2004 and currently it is Rm 24.00, an increase of Rm Rm 20.00 in 10 years, ie 5 times in 10 years.

Between the 2 companies, Batu Kawan is a better buy. If you buy Batu Kawan you will get about 18% return per year plus about 4.0% as dividend = 22% per year.

If you make use of margin finance costing 4.6% per year, you can easily get another 10% per year at least, totaling 32% per years. You just buy and keep for a long term and you don’t have to do anything.

As you know all shares fluctuate in price. If you sell some when the price is high and buy back when the price is low, you can further improve your profit.