Koon Yew Yin 5 Aug 2020

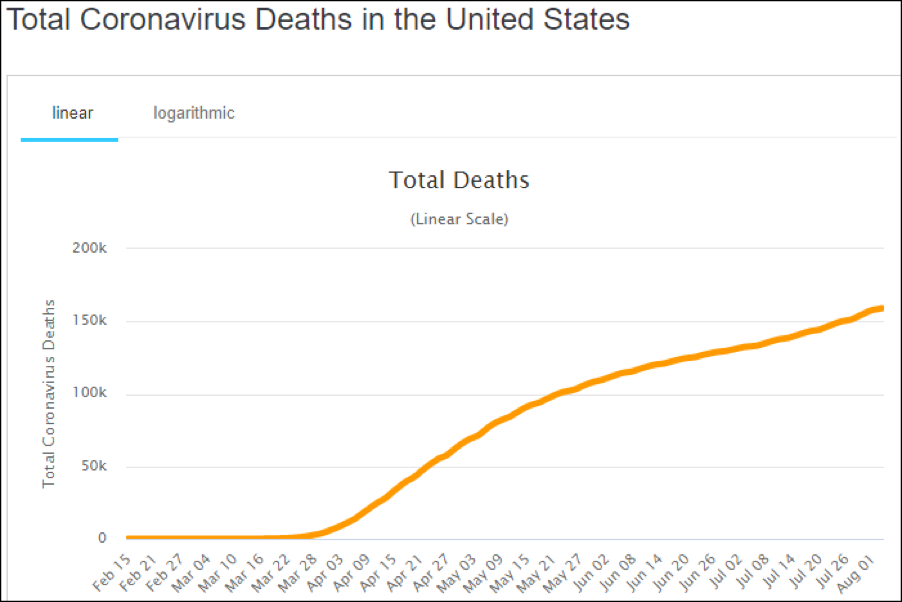

Currently there are 4.8 million Covid 19 cases and 159,000 deaths in the US. Unfortunately, these 2 figures are still spiking up. The US has the most Covid 19 cases in the world. The US population is about 5% of the world population but it has about 25% of the total Covid 19 cases in the world.

President Trump could have saved thousands of lives if he had followed the advice given by his public health adviser Anthony Dr Fauci. Until a week ago, he did not even believe in wearing face mask. Obviously, Trump is like a blind man and he does not know how to resolve this catastrophe.

The 2 charts below are self-explanatory.

The Covid 19 pandemic is affecting everybody, all business activities, all listed and non-listed companies. As a result, the number of jobless claims is increasing continuously and the Government has to print more and more money to subsidise the jobless people and small businesses. As a result, the US dollar will continue to plunge.

listed and non-listed companies. As a result, the number of jobless claims is increasing continuously and the Government has to print more and more money to subsidise the jobless people and small businesses. As a result, the US dollar will continue to plunge.

What will happen if the US dollar is no longer the world currency?

If the dollar loses its status as the reserve currency, it would be a major shift in the global economy the likes of which only happens once or twice a century. … Because the dollar is the reserve currency, central banks around the world hold large amounts of dollar-denominated assets, mostly U.S. government bonds.

The US is the evillest nation in the world

The US has been the richest and most powerful nation in the world for more than a century. In fact, the US imposed trade sanctions on countries if they did not want to use US currency. That is why the US declared war on Iraq when Saddam Hussein did not want to use US currency to sell oil. Moreover, the US with its military power declared war 13 times after the 2nd world war. The US dropped more bombs in Vietnam that it did in the 2nd world war.

The recent tumble in the value of the dollar is just the beginning of a far greater plunge that is about to materialize, analysts say.

That will likely put further stresses on an already beleaguered economy and could make re-election for the Trump administration harder.

“Our FX [foreign exchange] strategists believe that the recent decline in the USD is just the beginning of a larger structural downtrend in the greenback driven, in part, by a further recovery in the global economy,” states a recent report from iconic Wall Street bank Goldman Sachs GSBD .

The statement comes after an already severe decline in the dollar index, which started three months ago. The dollar index was recently trading at around 97 down more than 5% from 102.8 on March 20, according to data from Bloomberg.

However, that drop, which was relatively swift and significant, may be only the beginning of a larger tumble in the value of the greenback, the report states.

“They [the Goldman analysts] estimate that the USD may fall more than 20% from its recent peak,” the report state. That means it could drop to 84, a level it hasn’t seen in the last five years.

Why should investors care? In the first place, a weaker dollar tends to make the economy grow slower than it otherwise would. The reason is that when a currency is declining or at least isn’t stable investors tend to invest their money elsewhere.

Falling Dollar Could Sour the Election for Trump

Another problem with the value of the dollar falling is that it is by definition inflationary. If one dollar buys less today than it did yesterday, then you have inflation. It will mean gasoline prices, and food prices will likely see increases and at a time when wages will likely be stagnant and unemployment high.

People tend to vote out incumbents when they find that the combined percentage unemployment rate and percentage inflation rate rise over the four years since the last election.

The Disadvantages of a Weak Dollar

When the United States dollar weakens, which is indicated by a drop in its buying power in comparison to foreign currencies, the financial effects are like ripples on a pond. The degree to which your business feels this ripple effect depends upon how closely your business depends on the increased price of goods and services. On a national scale, a weak dollar can boost the gross domestic product during an economic downturn. Because exported goods cost less, foreign buyers purchase them in greater amounts. If you’re not in the export business, a weak dollar can negatively impact your company.

Consumer Spending

A weak dollar drives up the price of imported products, many of which line big-box store shelves. This leads to reduced consumer spending. To compensate for fewer sales, retailers may hike the prices of other products in an attempt to generate more revenue, which only contributes to the problem. When consumers tighten their belts, the first industries that take a hit are those that manufacture luxury items and nonessential products.

Fuel Costs

Gas prices at the pump typically move in opposition to the movement of the U.S. dollar. When the dollar weakens, the price of gasoline increases because the nation depends, at least in part, on imported oil. If your business delivers goods or services, or if it depends upon rising utility costs to operate, your overhead costs increase. You have three choices: pass on the higher cost to the customer, absorb the higher cost and compensate by cutting quality, or take a financial loss. None of those options is favorable to business.

Wages

Your employees would probably like a wage increase to offset the higher costs they’re paying for consumer goods. Because you’re paying more for wholesale merchandise as well as fuel, chances are good that you can’t afford to give your employees a raise. If the dollar weakens more, you might end up having to lay off good workers or cut their benefits, making you less competitive in the marketplace.

Businesses Impacted by a Weak Dollar

Some types of business feel the financial pinch of a weak dollar more than others, including travel agencies that sell foreign vacations and businesses that depend on buying foreign goods for resale or for use in producing other products. Car dealerships that sell imported automobiles, jewellers who depend upon imported diamonds and retailers who sell coffee, alcoholic beverages, bananas and other imported goods report lower profit margins when the dollar weakens.