Koon Yew Yin 16 Sep 2020

Few weeks ago, Warren Buffett’s Berkshire Hathaway revealed 5% stakes worth a total of USD7bn in 5 Japanese trading house giants – Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo. These are large companies with wide range of businesses across many industries around the world. In fact, Berkshire Hathaway said it might increase its holdings to 9.9% in any of these five trading houses.

Perhaps, Warren Buffett and his lieutenants, Todd Combs and Ted Weschler, should consider taking a look into Malaysia’s big 4 rubber glove manufacturers – Top Glove, Hartalega, Supermax and Kossan. It’s hard to come by for a global market leader emerging from Malaysia. This time, we have 4 at one time from the same industry.

These companies fit perfectly with his investment thesis:

- The companies are run by the founders

- They have high returns on equity

- Huge economies of scale

- They produce a product that is used globally, with consistent increase in demand, with or without pandemic

- The big 4 control a significant global market share (>50%)

- A hedge for Berkshire Hathaway’s portfolio of companies that are vulnerable to pandemic (should it occur in the future again)

Combined, these give them a deep economic moat, a characteristic that Warren Buffett looks for in companies.

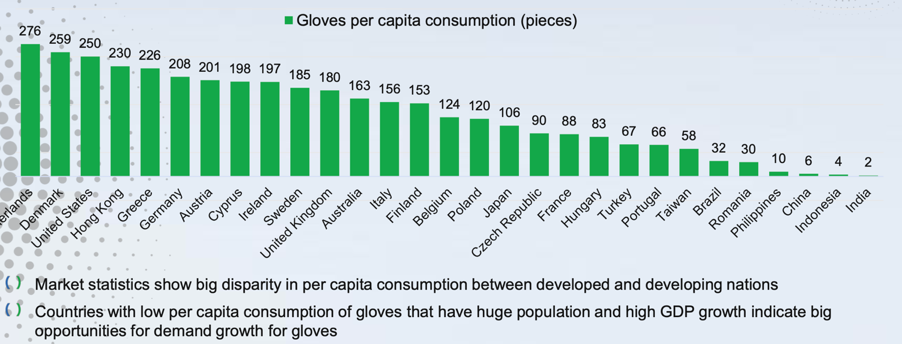

Even as the world discovers vaccine for Covid-19 eventually, the rubber gloves industry trajectory is on a long-term upward trend with demand coming from developing countries as they grow and healthcare awareness and infrastructure improves. Note the huge disparity in gloves per capita consumption between developed and developing countries, especially the scale of these countries on the right side of the chart (ie. China, Indonesia, India). You can watch here Kuan Mun Leong, CEO of Hartalega, commenting during Hartalega’s 2020 AGM on 15 Sep 2020 regarding the ‘structural step up in demand’ due to change in users’ behaviour

The total market cap today of the big 4 is RM163billion or USD40 billion. Berkshire Hathaway has a cash pile of USD146billion on their balance sheet. The big 4 are sizeable and liquid enough to absorb such size of investment and also make meaningful returns given Berkshire’s scale.

If the Oracle of Omaha follows the same playbook as their investment in the Japanese trading houses and takes up:

- 5% of the big 4, that is a USD2billion investment or 1.4% of their cash pile

- 10% of the big 4, that is a USD4billion investment or 2.7% of their cash pile

This would raise the profile of our Malaysian companies, attract more international funds to invest into these big 4 and make Malaysia famous for the right reasons.

Warren Buffett should start wearing gloves for Berkshire Hathaway.