Koon Yew Yin 9 Dec 2020

Today Top Glove announced its historical record profit. Its share price plunged which dragged down all the other glove stocks which is so illogical.

Top Glove Corporation Bhd PRESS RELEASE

A STRONG AND HEALTHY START TO FY2021 FOR TOP GLOVE, Wednesday, 9 December 2020 Top Glove Corporation Bhd (Top Glove) today announced its financial results for the First Quarter or 1QFY21 (from 1 September to 30 November 2020), delivering a robust performance underpinned by continued strong global glove demand. For 1QFY21, the Group achieved Sales Revenue of RM4.8 billion, up 294% compared with 1QFY2020, and 53% quarter-on-quarter.

Profit After Tax Attributable to Owners of the Parent (Profit) surged by 20 times to RM2.4 billion versus the corresponding period in FY2020, and doubled against 4QFY2020.

Meanwhile, Sales Volume (Quantity Sold) improved by a healthy 34% from 1QFY2020. The Group’s robust Sales figures were attributed to the strong demand for gloves in both developing and emerging markets, owing to the ongoing global pandemic. The improved Profit came on the back of higher sales output, high utilisation levels which amplified production efficiency, as well as higher average selling prices (ASPs) in line with market pricing.

Moreover, ongoing technological advancements towards automation and digitalisation initiatives, effective talent development, as well as continuous innovation, quality and productivity enhancements which the Group continued to embark on, also contributed to the improved bottom line.

My comment:

Top Glove just announced its historical best result of 29.64 EPS. Its profit is 5.6 times its previous quarter and 20 times its profit for its corresponding quarter last year.

Yet, today its share price plunged which has dragged down all the other glove stocks. It is so illogical.

EPF has been selling every day since 4 Dec. With due respect, over the years EPF’s track record has not been so successful. Unfortunately, many weak holders and Investment Banks are also following EPF to sell their holdings aggressively.

You can see from Top Glove’s press release that due to Covid 19 pandemic, the demand for gloves will continue to exceeds supply. As a result, the company could easily increase its selling price to make 20 times more profit than its corresponding quarter last year.

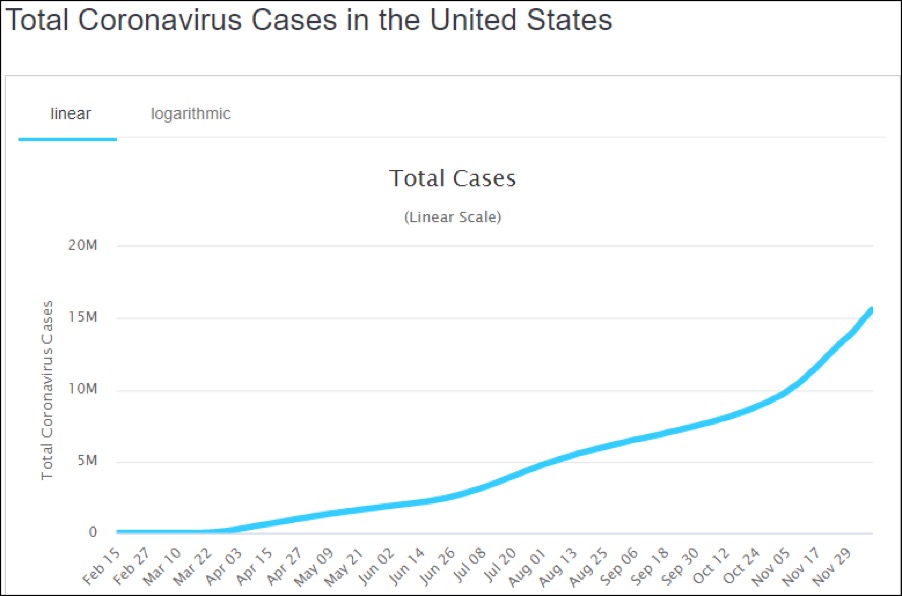

Currently US has a total of 15.94 million Covid 19 cases and 293,446 deaths. The daily number of new cases is still spiking in US as shown on the chart below.

Yesterday, there were 219,944 new cases. That means there will be more than 1 million new cases every 5 days.

The new US Government is desperately pressuring FDA to approve the use of vaccine. Even if the vaccine is finally approved by FDA, it will take a long time to produce enough of vaccine to inoculate at least 70% of the people in the whole world to stop the spread of the coronavirus.

Additional glove required

Currently there is already a shortage of medical gloves. Additional glove will be required when vaccine is approved for use because all medical staff will have to wear glove to inject the vaccine as the photo shows.

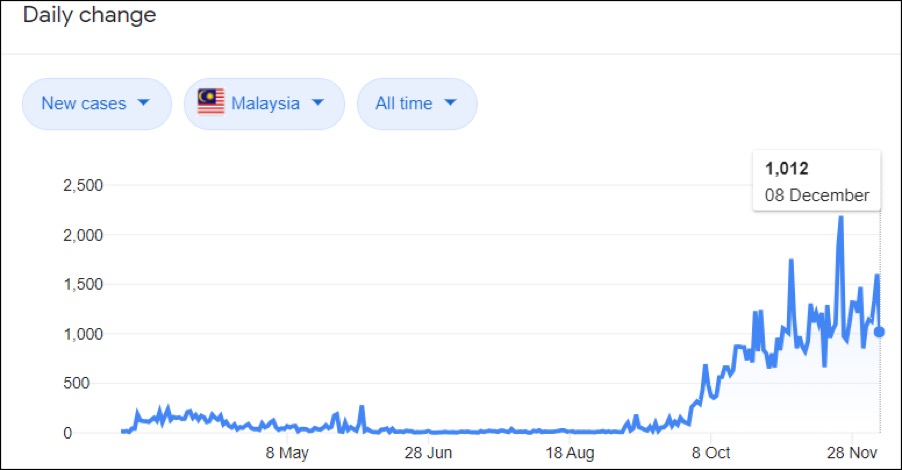

US has the most Covid 19 cases in the world. You may like to know that Malaysia has a total of 76,265 Covid 19 cases and 393 deaths. Yesterday we had only 1,012 new cases as shown on the chart below.

My conclusion:

Top Glove just reported EPS 29.64 sen. Its previous quarter was 5.32 sen, an increase of 5.6 times. Supermax reported EPS 30.58 sen for its 1st quarter ending September. Its next quarter ending December will be announced in Mid-January. Based on Top Glove’s profit growth rate, Supermax’s profit should be another new record high. All serious investors must wait patiently for another 5 weeks.