Koon Yew Yin 14 Dec 2020

On 12 December JP Morgan downgraded Top Glove share price to Rm 3.50, nearly 50% of its current market price of Rm 6.90. Top Glove just reported EPS 29.64 for its quarter ending November. Its previous quarter EPS was 5.32 sen, an increase of 5.7 time. Comparing to its corresponding quarter last year, it has gained 20 times.

JP Morgan also downgraded Hartalega.

JP Morgan did not downgrade Supermax and other glove stocks because it did not own them.

Supermax reported 30.58 EPS for quarter ending September. Its EPS for its previous quarter was 15.19 sen. Based on Top Glove’s performance, Supermax’s profit for next quarter ending December should be another record profit which will be announced in Mid-January, about 1 month from now.

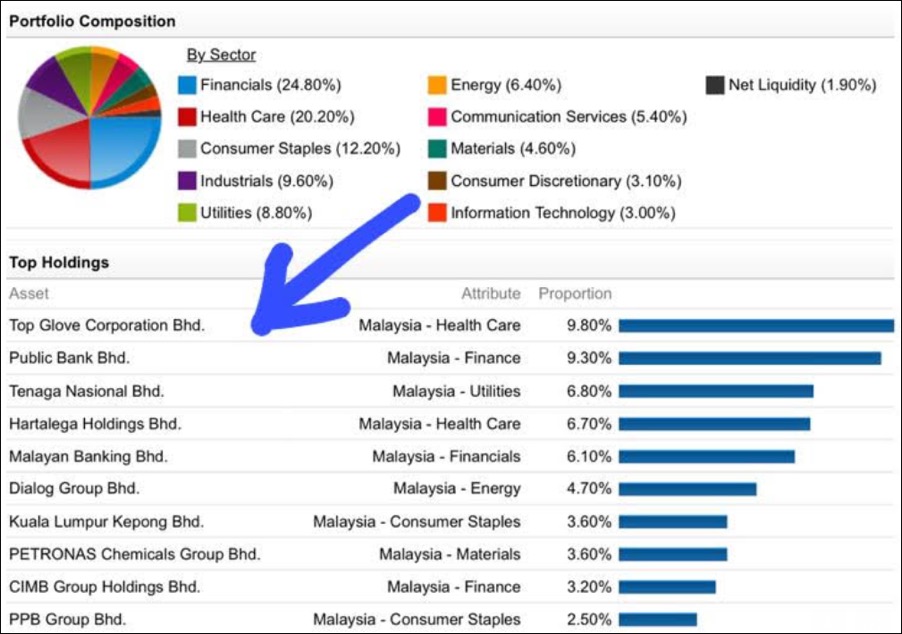

The table below shows that Top Glove is JP Morgan’s largest holding. Its 4th largest holding is Hartalega. Why should it downgrade Top Glove and Hartalega?

Obviously, JP Morgan wants to depress their share prices so that it can buy them at cheaper prices.

Due to Covid 19 pandemic the demand for medical gloves far exceeds supply and all the glove makers can easily increase their selling prices to make more and more profit. That is why Top Glove can report such an unprecedented profit. Until the pandemic is completely under control, the demand for medical gloves will continue to exceeds supply and all the glove makers will continue to increase their selling prices to make more and more profit.

This JPM article is a very poorly reasoned one. It is obvious that it is another shameful attempt to spook glove investors into selling and thereby creating buying opportunity for the fund managers in JPM.

As a serious glove stock investor, I need to debunk some of JP Morgan’s reasons for downgrading Top Glove and Hartalega.

1 JP Morgan: the price charts for all the glove stocks started to trend downwards from their peaks since September. Therefore, glove prices have peaked.

Rebuttal: Top Glove just reported EPS 29.64 for its quarter ending November. Its previous quarter EPS was 5.32 sen, an increase of 5.7 time. Comparing to its corresponding quarter last year, it has gained 20 times.

2 JPM: Glove production capacity is expected to grow 87% in the next three- to five years

Rebuttal: JPM claims that an 87% growth in production capacity (if true) over 5 years will lead to over-supply. But 87% growth over 5 years is only 13.3% per year compounded. Top Glove’s CAGR for the last 5 years was 23.6% and the 4 years before the Covid pandemic was 13.5%.

3 JMP: Additionally, glove makers’ profitability is expected to be negatively affected by higher raw material prices and rising labour costs.

Rebuttal: Raw material and labour cost increases is a fact of life and applies to almost all manufacturing industries. And as cost increases applies to all competing companies, the increased costs are usually passed on to the consumer. This will not affect profitability. By bringing up the cost issue, which is a non-issue, JPM is clearly trying to stretch its argument to justify paring the fair value of Top Glove’s share price to RM3.50.

4 JPM: Retail and foreign participation are at all-time highs. It is thus difficult to find incremental dollars to drive this sector higher

Rebuttal: There is no sense to this statement. Investors come and go; buy and sell. Money will always chase profitable growth stocks when negative sentiments are proven wrong.

5 JPM: Top Glove is using cash to support capacity growth instead of debt

Rebuttal: Yes ROE will be higher with use of debt but ROE is already very high anyway. And prudence in using surplus cash is not necessarily bad.