Koon Yew Yin 20 Oct 2020

On 15 Oct 2020, Mah Sing proposed to diversify its business to include manufacturing and trading of gloves and related healthcare products. As soon as this hot news was known publicly, many investors rushed to buy Mah Sing shares. As a result, its share price shot up from 72.5 sen to 94.5 sen, an increase of 22 sen or 30.4% limit up. It continues to shoot up higher and higher.

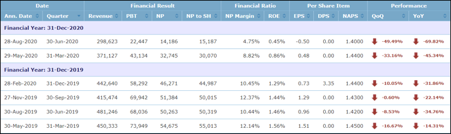

The table below shows that the company has been reporting reduced profit in the last 6 quarters. In fact, it reported loss in the latest quarter.

As a co-founder of Rubberex, I should know the difficulty and time required to construct a new factory to manufacture gloves. With more than 30 years of experience, Rubberex took more than 2 years to complete the construction of the new factory and a few months to test run.

Investors should not buy it because it will take more than 3 years to start producing gloves and another one year to show profit, assuming its profit from the sale of gloves can cover the losses from its property business. Just open your eyes you can see there are so many unsold properties in every town and cities in Malaysia. I will take many more years to resolve the problem.

The Covid 19 pandemic is affecting everyone’s movement and income. That is why so many people cannot afford to buy a new house or condo.

In Ipoh I know there are already a few property developers being foreclosed by the banks.

Statistics shows that more than 90 percent of the investors lose money in the stock market. That is why there are so many stupid investors rushing to buy Mah Sing shares.